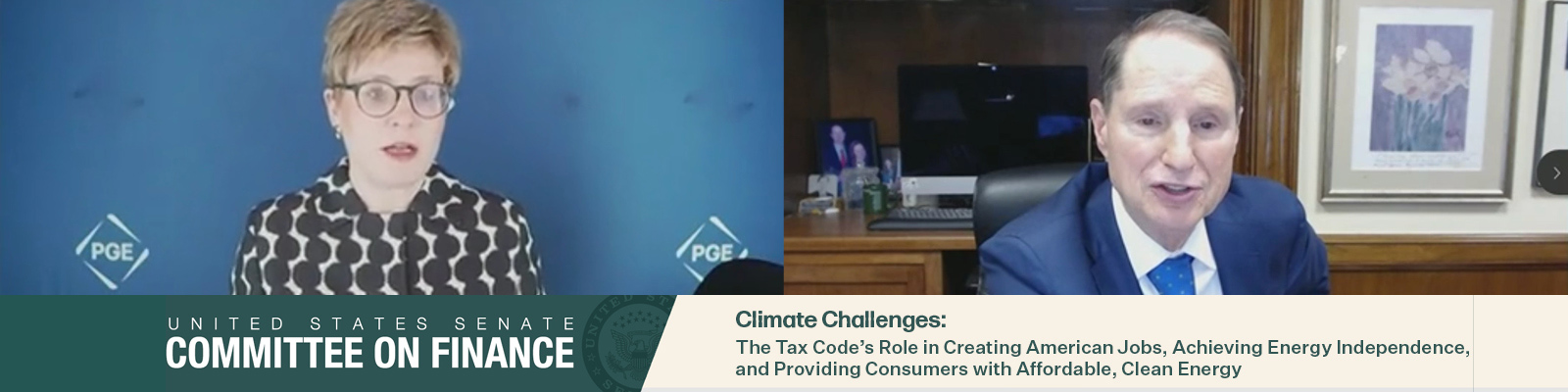

PGE CEO Maria Pope testifies in front of U.S. Senate Finance Committee in support of Sen. Wyden’s Clean Energy for America Act

Apr. 27, 2021

SENATE FINANCE COMMITTEE HEARING ON

“Climate Challenges: The Tax Code’s Role in Creating American Jobs, Achieving Energy Independence, and Providing Consumers with Affordable, Clean Energy”

Testimony of Maria Pope, President and CEO, Portland General Electric

Chairman Wyden, Ranking Member Crapo, and Members of the Committee, my name is Maria Pope, and I am the President and CEO of Portland General Electric. I am honored to testify before you today on the critical issues of climate change, jobs and effective clean energy tax policy. Thank you for taking up this very important issue. Climate change is having very real global impacts and greenhouse gas emissions must be dramatically reduced on an economy-wide basis. It will take all of us working together to make a difference. National attention and an all-hands-on-deck approach is needed without further delay. Portland General Electric is a fully integrated electric utility based in Portland, Oregon. We serve roughly half of all Oregonians and three quarters of the state’s industrial and commercial activity. We share our customers’ and our communities’ vision for a clean, reliable, affordable energy future. We have ambitious climate goals to reduce greenhouse gas emissions associated with the power we serve customers by at least 80 percent by 2030, compared with 2010 levels. We also have an aspirational goal of zero greenhouse gas emissions associated with the power we serve to customers by 2040. Advancements in policy, regulation, and technology are needed to meet these emission reduction goals, while maintaining reliable service at a reasonable cost to customers. PGE is not alone in our emissions reduction work. Many of our peer utilities across the country have set similarly ambitious targets. The Edison Electric Institute’s members, representing the nation’s investor-owned utilities, are collectively on a path to reduce their greenhouse gas emissions at least 80 percent by 2050, compared with 2005 levels. Many companies are pledging even faster, more aggressive timelines. As of year-end 2019, the U.S. power sector had reduced its CO2 emissions by 33 percent below 2005 levels.

According to the Intergovernmental Panel on Climate Change, we have a decade to make significant progress to curb greenhouse gas emissions. To achieve that progress across the energy sector on the timeline climate science requires, deployment of clean energy resources by utilities and others in the energy industry must be accelerated. Utilities, or any sector of our economy, cannot achieve these ambitious emissions reductions alone. Addressing the climate crisis requires substantial capital investments and federal policies that serve everyone equitably – maximizing both benefits to customers and the deployment of a wide variety of clean energy resources.

It is also imperative that federal policy does not pick winners and losers regarding technologies or which entities can deploy the new resources that will be needed. It’s clear that the nation needs all parties, especially those responsible for delivering reliable power, to be able to develop and deploy new resources. The right technology-neutral incentives will accelerate the clean energy transition and activate all players to make significant investments. This committee has the authority to provide those well-designed incentives via the tax code. To move forward with speed requires new thinking, which is exactly what we see in the Clean Energy for America Act. Chairman Wyden, I want to thank you and your team for this newly introduced and thoughtfully crafted bill. This legislation provides tax incentives in a manner that addresses many of these issues I just identified. Notably, your bill will help incentivize utilities and independent developers alike to transform how electricity is generated and used. It is designed to ensure success as it doesn’t pick winners and losers - in terms of technology or business model - and is flexible in that it covers emerging technologies as long as they have zero or net negative carbon emissions. This bill reflects the findings from a recent analysis by the Rhodium Group which concluded that this kind of long-term technology-neutral approach enables all parties to participate in the path to a clean energy future, creating an opportunity for an all hands on deck approach to drive down electricity sector greenhouse gas emissions.

Portland General Electric enthusiastically supports this bill, and we urge its enactment. The Clean Energy for America Act recognizes that utilities play a critical role in meeting ambitious greenhouse gas reduction and clean energy targets and, at the same time, need support to deploy new clean electricity resources and technology supportive of the transportation sector’s transformation. The bill paves the way for us to boost investments - more quickly and equitably - to meet our shared goals of reducing emissions and addressing climate change. We especially appreciate the optionality between production and investment tax credits, while also allowing utilities to opt-out of Internal Revenue Service normalization requirements for the new storage credit. These provisions ensure that the full benefits of these tax incentives are passed through to customers and that regulated utilities will not be disadvantaged – leveling the playing field to accelerate deployment and ensure affordability for all customers. Keeping energy affordable helps build and maintain the broadest support for this critical transition. Along with affordability, preserving reliability is essential. Dispatchable clean resources will play an important role. So will a smarter grid that can harness electricity from wind, solar and other resources when they are available and store that energy for when it’s needed. Chairman Wyden’s bill provides tax incentives for stand-alone energy storage facilities and new clean resources that provide important capacity, leading to improvements in reliability.

The bill also provides the option to elect direct payment of these credits. The option enables broader use and lowers costs, creating savings which can be directly passed on to customers. For example, direct pay can financially insulate the development of these projects during challenging economic conditions such as the financial crisis in 2008 or the pandemic that we are currently experiencing. It also mitigates the need for complex tax equity transactions, where credits are heavily discounted by large commercial and investment banks or other parties. Instead, with this option, the benefits of the tax credits can more fully flow through to utility customers and lower the cost of the clean energy transformation. The Clean Energy for America Act requires that eligible facilities must be built by workers who are paid prevailing wages. PGE values our partnership with labor, including the IBEW, and we support this requirement. We are pleased that the Blue Green Alliance is here today to discuss their perspective.

Today, the transportation sector is the largest source of greenhouse gas emissions. The bill’s clean transportation credits enable transformative change, encouraging the purchase of a range of electric vehicles and investment in critically important charging infrastructure. These credits will help us meet our commitment to electrify our own fleet and will also enable our customers to make the transition to electric vehicles, important steps if our state is to meet its decarbonization goals. PGE appreciates and values the inclusion of Chairman Carper’s charging infrastructure proposal for robust charging credits that will boost installation and provide access across the nation.

I would like to express again my appreciation for Chairman Wyden’s thoughtful legislation. As we continue our transition to clean energy resources, what we need from Congress are the tax incentives contained the Clean Energy for America Act, as well as federal funding for the research, development and deployment of new technologies that will help us deliver dispatchable clean energy resources. These federal investments will enable utilities to reach deep reductions in greenhouse gas emissions.

As Congress begins discussion on an infrastructure package, there is an opportunity to include provisions to help modernize the electric grid and transition the nation to the clean infrastructure of tomorrow. This includes legislation such as Chairman Wyden’s Clean Energy for America Act. We are also aware that Ranking Member Crapo has developed his own tax legislation. We look forward to working with Ranking Member Crapo, his staff and the Committee as these proposals move forward in the months ahead.

Chairman Wyden, Ranking Member Crapo, Committee Members, thank you for your time and the opportunity to share our perspective on these important matters.